What is a Mortgage?

A mortgage is defined as the type of loan used to purchase or maintain a home, land or other essential real estate complexes.

The borrower is simply taking a loan against a property they wish to purchase. He/she is agreeing to pay the entire loan back to the lender over a specific period of time.

This can be done typically in a series of regular transactions or payments that are divided into two most common factors i.e. principal and Interest. The property then serves as collateral if the loan is not paid back as outlined in the contract.

The property in question could be your home or agricultural land and shop. Mortgage loans are offered by both banking and non-banking financial agencies and organizations.

Several types of Mortgages

Mortgage varies from type to type and a few of them are entitled below:

Fixed-rate Mortgage

As its name suggests, it's a standard type of mortgage in which the interest rate remains the same for the overall loan duration. The borrower usually pays out his/her instalments including the fixed interest rate. A fixed-rate mortgage is often known as a traditional mortgage.

Adjustable-Rate Mortgage (ARM)

Float-based interest rates are often known as adjustable. In this, the interest rates are adjusted per the prevailing market rates. Here the interest rate is fixed for an initial term plan and after which it can change periodically as per the prevailing interest rates.

The starting interest rate is quite often below the market rate which leads to mortgages being more affordable in a shorter duration or time or term but less cost-effective for the long-term if the rate rises significantly. This type of loan was the main cause of the housing crash in 2007/2008. The interest rates starting to become more expensive and made the owner’s payments unaffordable.

Reverse Mortgages

Reverse mortgages are quite a difficult financial product. They are specially designed for homeowners aged 62 or above who want to convert part of the equity or stakes in their homes into cash. Such owners can borrow the money against the exact value of their home and receive the money as a lump sum or a monthly payout to help supplement other expenses

There is a major concern for some individuals in that, if and when the borrow dies, moves or outlives the money, their family may be left without the property or the money.

Interest Only Loans

Other, lesser popular mortgages can have intricate repayment schedules and are best used by knowledgeable borrowers. Examples include interest-only mortgages and payment-option ARMs. These loans could have a sizable down payment due at the end, called a balloon payment. A balloon payment may result in refinancing the property or selling the property to pay back the loan.

Pros of getting a Mortgage Loan

After discussing what a mortgage loan is and some of its key characteristics, let's look at some of its advantages.

- As long as you use the loan money to meet your needs, you will still be the property's owner in legal terms.

- Given that they are secured loans, mortgage loans are frequently granted.

- In comparison to personal loans, mortgage loans have substantially lower interest rates.

- Flexible repayment terms are available.

Why do people need Mortgages?

People require a mortgage because the price of a home is often far greater than the actual amount of money usually most households use.

Therefore, mortgages enable people and families to buy a home by making a relatively small down payment, like 0%, 3.5%, 20% of the buying price, and getting a loan for the remaining amount. If the borrower defaults, the property value serves as security for the loan.

Core Reasons to take out Mortgage Loan

A Mortgage loan can be taken due for numerous reasons, a few of them-

- Funding a medical emergency

- Paying for children’s higher education or abroad settlement.

- Paying for your children’s wedding

- Business expansion

- Home Renovation

How do Mortgage rates inflation and home price appreciation interact?

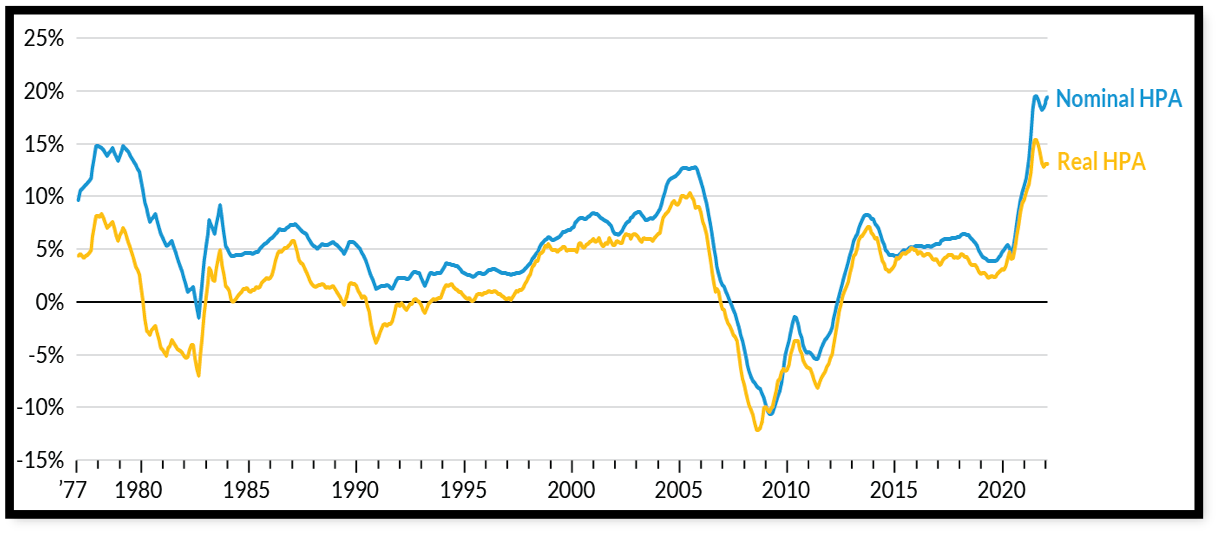

Mortgage interest rates have emerged by more than 2% since the end of 2022. Mortgage payment amounts have also risen from $1,283 on a $300,000 home at the end of 2021 to $1,629 on the same home, a 27% increase.

As long as housing prices stay high and price growth is strong, affordability issues will persist. In the upcoming months, one might anticipate that home price growth will be slowed to below-average levels by considerably higher rates.

Quickly rising interest rates that Slow down-home Price Appreciation

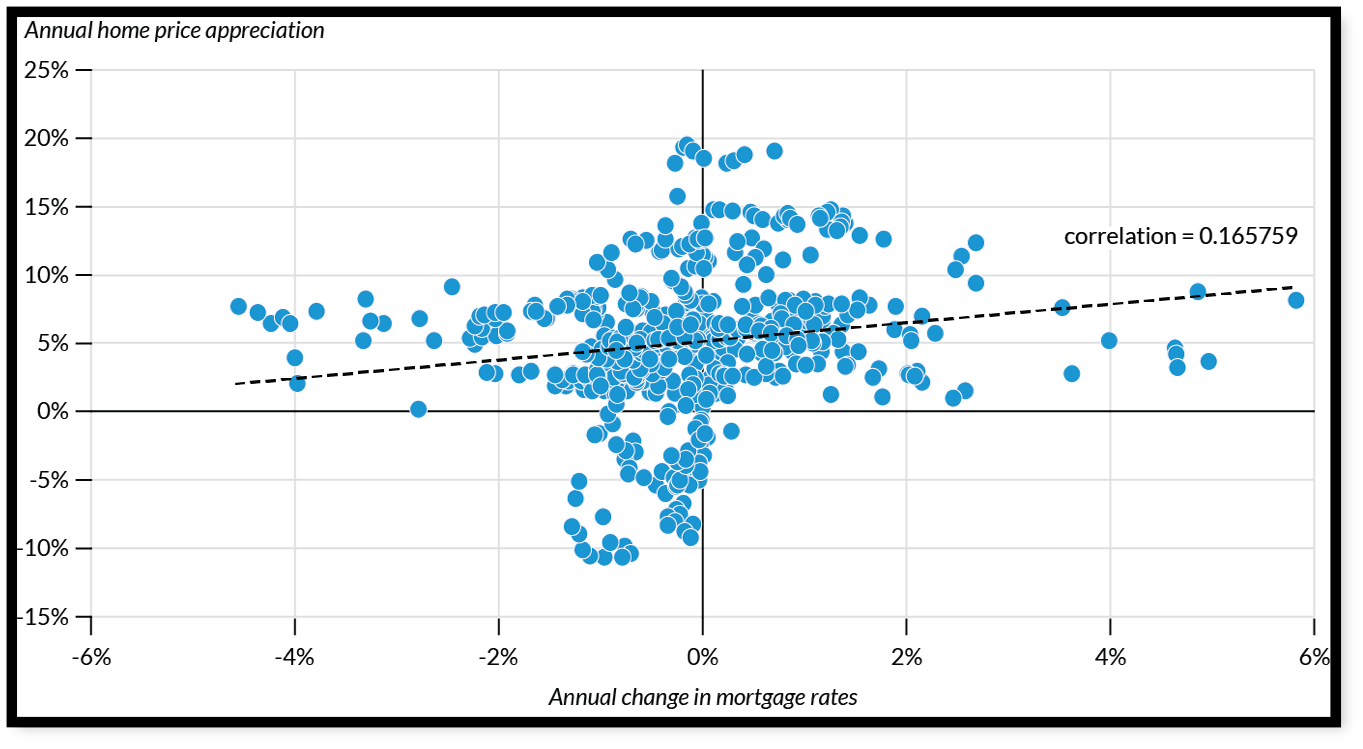

The rapid increase in interest rates' impact on home price appreciation is not taken into account by the historical link between mortgage rates and house prices.

Since 1976, mortgage rates in the United States have fallen, and there have been few instances where they have risen by more than 1.5% annually.

Additionally, even though the expenses of homeownership for first-time buyers are initially higher than those of renting, potential homeowners may still decide to buy since inflation alters the calculation.

Future rental payments that incorporate rent hikes are less appealing to prospective homebuyers than the mortgage payment they would lock in now. Additionally, because they can lock in their financing costs and anticipate increasing rental income, investors are willing to pay more.

Critical Factors that Affects your Mortgage Rates

Mortgage payments are comprised of two parts: Principal and interest payments.

The principal is the part of your transaction that goes directly towards your balance. Whereas the interest is the overall cost of borrowing the money. Your loan pending balance or mortgage interest rate determines your monthly instalments.

Credit Score

A better credit score plays an important role in making or breaking your reputation. The same scenario applies in the mortgage loan case.

In general, your mortgage rate will be preferable the higher your credit score. Typically, customers with credit scores of 740 or higher are given the lowest rates by banks.

Down Payment

Less capital is at the stake for the creditor if there is a greater down payment. A significant down payment is often rewarded by the lender with a lower interest rate. Small down payments incur higher rates and are hazardous.

Loan Program

Mortgage loans come in a variety of forms, and some have more affordable rates than others. A VA loan, for instance, offers one of the cheapest interest rates while only being available to veterans, active military personnel, and surviving spouses. A reduced down payment and credit score may be offered through an FHA loan, but only for first-time homeowners.

Loan Type

You can opt for a fixed-rate mortgage or an adjustable-rate mortgage. With flexible-rate loans, your interest rate is low at one instance but can rise over time. Although the rates on fixed-rate mortgages are often a little higher, they remain the same for the whole loan term.

Loan Term

There are several terms, or lengths, for mortgages. The interest rate for a short-term loan is typically lower than that of a long-term mortgage. For instance, the average annual interest rate for a 30-year fixed rate loan was 2.96% in 2021, while the rate for a 15-year loan was 2.27%.

While we are not lenders or mortgage brokers and Innovation Property Management, Inc., we certainly can get you in touch with trusted ones we have used many times. Please feel free to reach out to us with any questions.